Liquid Biopsy Market Size Worth USD 22.69 Billion by 2034 Amid Rising Demand for Minimally Invasive Cancer Testing

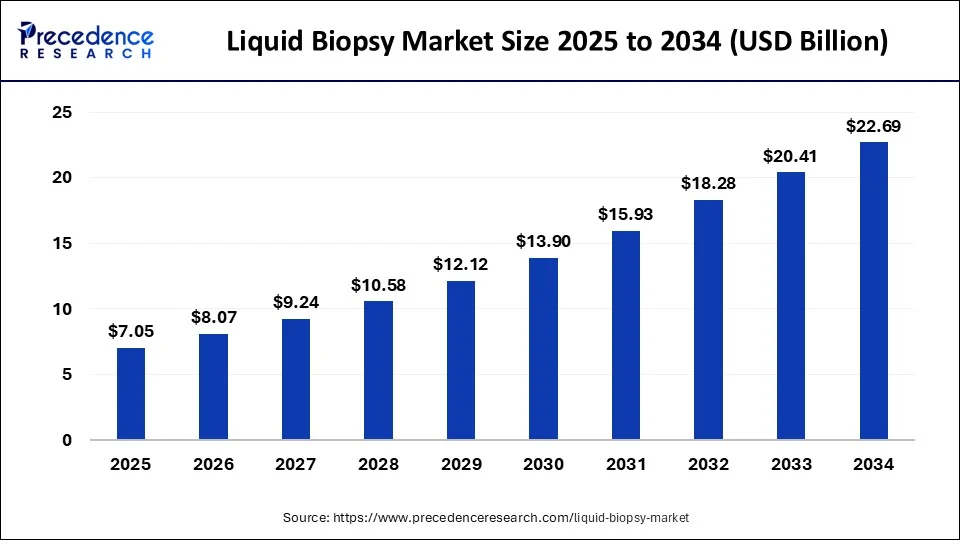

According to Precedence Research, the global liquid biopsy market size will grow from USD 7.05 billion in 2025 to nearly USD 22.69 billion by 2034, expanding at a strong CAGR of 13.91% from 2025 to 2034. The North America liquid biopsy market size was calculated at USD 2,810 million in 2024 with an expected CAGR of 13.95%.

Ottawa, Sept. 16, 2025 (GLOBE NEWSWIRE) -- The global liquid biopsy market size is expected to be worth over USD 22.69 billion by 2034, up from USD 8.07 billion in 2026. In terms of CAGR, the market is expected to expand at a notable compound annual growth rate (CAGR) of 13.91% between 2025 and 2034.

The rising trend of minimally invasive medical procedures like liquid biopsy and their advantages over traditional biopsies drives their acceptance in the management of diseases like cancer.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1398

Liquid Biopsy Market Key Takeaways

- In terms of revenue, the global liquid biopsy market was valued at USD 6,170 million in 2024.

- It is projected to achieve USD 22,690 million by 2034.

- The market is expected to grow at a double CAGR of 13.91% from 2025 to 2034.

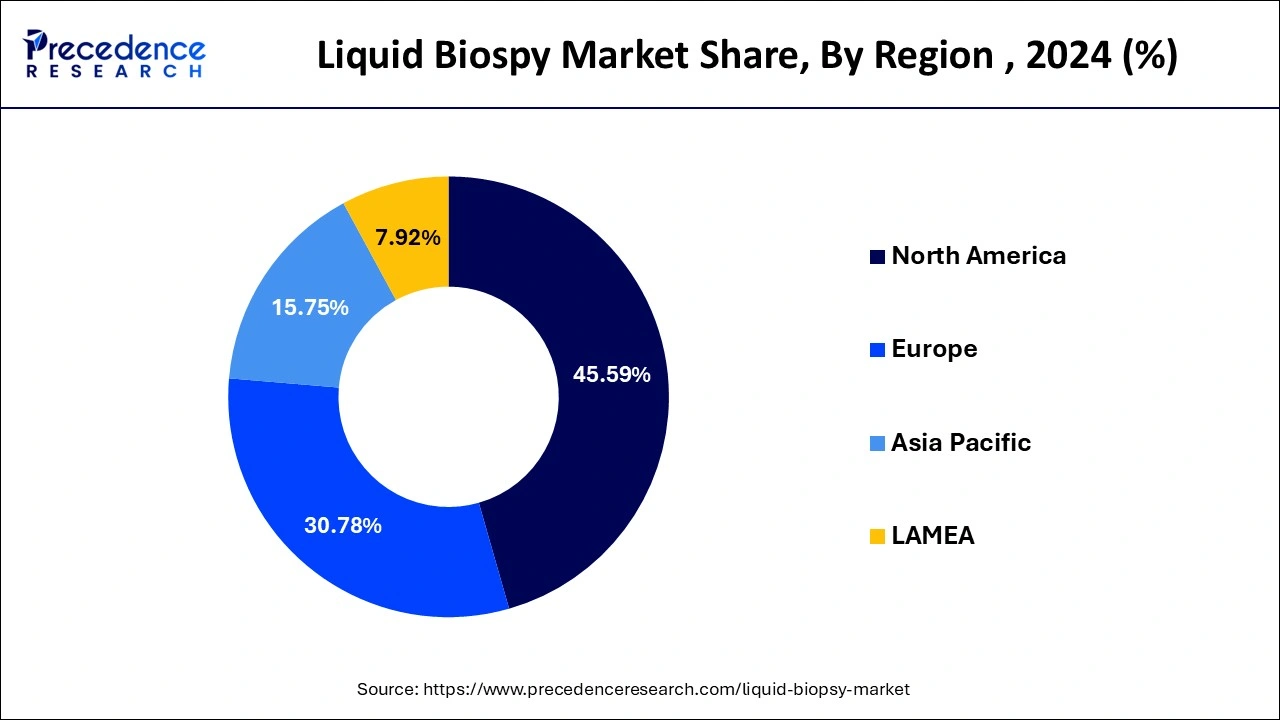

- North America accounted for the largest market share of 45.59% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By technology, the NGS segment contributed the largest market share of 65.20% in 2024.

- By technology, the polymerase chain reaction (PCR) segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By usage, the clinical segment contributed the highest market share of 72.17% in 2024.

- By products, the test/services segment held the major market share of 53.12% in 2024.

- By products, the kits and consumables segment is growing at the solid CAGR from 2025 to 2034.

- By indication type, the lung cancer segment accounted for the considerable market share of 32.10% in 2024.

- By indication type, the breast cancer segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By clinical application, the treatment monitoring segment led the market in 2024.

- By clinical application, the prognosis and recurrence monitoring segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By type of sample, the urine segment dominated the market in 2024

- By circulating biomarkers, the cell-free DNA segment led the market in 2024.

What Role Does Liquid Biopsy Play in Advancing Oncology?

The liquid biopsy is the cornerstone in precision medicine and is a key tool in oncology. Early cancer detection is supported by genomic profiling, gene expression pattern recognition, and mutation detection techniques.

In April 2025, Labcorp launched molecular residual disease and liquid biopsy solutions to help clinicians in the assessment of recurrence of stage III colon cancer patients. In February 2025, HaploX established a Japanese subsidiary for the expansion of biopsy and transomics analysis services.

What Are the Major Government Initiatives Supporting Liquid Biopsy?

1. Quad Cancer Moonshot Initiative

Launched by the governments of the United States, India, Australia, and Japan, this Indo-Pacific collaboration aims to reduce the burden of cancer, starting with cervical cancer, by improving early detection, including through liquid biopsy technologies.

2. NIH Precompetitive Collaboration on Liquid Biopsy

The U.S. National Institutes of Health initiated a collaborative effort to accelerate research and development of liquid biopsy tools for early cancer assessment, bringing together academia, industry, and regulatory bodies.

3. LIBRA – Liquid Biopsy Research Alliance (India)

Supported by public and private stakeholders, LIBRA is a not-for-profit initiative in India focused on democratizing access to liquid biopsy diagnostics through research, education, and outreach programs.

4. European Union’s Horizon 2020 Program

The EU has funded multiple projects under Horizon 2020 to support liquid biopsy research, including initiatives like CANCER-ID and LIQUIDBIOPSY, which aim to validate circulating biomarkers for cancer diagnostics.

5. China’s National Precision Medicine Initiative

As part of its broader precision medicine strategy, China has invested heavily in liquid biopsy research, particularly in ctDNA and CTC-based diagnostics, through national labs and biotech partnerships.

✚ Get the Comprehensive Analysis ➡️ https://www.precedenceresearch.com/liquid-biopsy-market

What are the Recent Innovations in the Market?

-

Residual Disease Detection and Therapeutic Monitoring: The various technologies related to liquid biopsies, such as cfDNA biology and tumor-naive mutation-based approaches, are minimally invasive, able to capture tumor, deliver fast turnaround time, and identify new targets. They help in ultra-sensitive detection while proving high accuracy. They accurately target tumor-specific mutations.

- Targeted Therapies and Immunotherapies: These advancements have expanded therapeutic options in lung cancer, especially in non-small-cell lung cancer. These innovations have simplified molecular diagnostics. The correct testing approaches favor real-time monitoring of the tumor and its evolving status.

Case Study: How a Multi-Site Cancer Network Scaled Precision Oncology with Liquid Biopsy + AI

Organization

A 14-hospital oncology network (“NorthRiver Cancer Alliance,” anonymized) operating across North America and APAC partner sites, serving ~65,000 oncology patients annually.

Starting Point / Challenge

- Tissue biopsies caused procedure delays (7–12 days average) and were not always feasible for frail patients or hard-to-reach tumors.

- Limited ability to repeat tissue sampling during therapy meant clinicians lacked real-time tumor evolution data.

- Molecular turnaround time (TAT) averaged 14–21 days, slowing treatment selection and clinical trial matching.

- Fragmented analytics: genomic reports, radiology findings, and labs lived in separate systems, limiting decision support.

Objectives

- Reduce time to actionable results for therapy selection.

- Enable longitudinal monitoring (minimal residual disease, resistance mutations).

- Expand access to biomarker testing across community sites, not just tertiary centers.

- Improve clinical trial matching rates and pathway adherence.

Solution Deployed

- NGS-based liquid biopsy (ctDNA panel) added as a first-line or complementary test to tissue biopsy.

-

AI-assisted analytics layer to:

- Flag emerging resistance variants (e.g., EGFR, ALK, PIK3CA) from serial liquid biopsy reads.

- Integrate multi-omics + electronic health records (EHR) data (labs, imaging summaries, prior therapies) to support tumor board decisions.

- Automate trial-matching against inclusion criteria using structured genomic outputs.

- Operational model: Hub-and-spoke logistics with standardized kits/consumables and courier pickup from community clinics; centralized lab for NGS; cloud dashboards for clinicians.

-

Governance: Molecular tumor boards every 2 weeks; quality metrics integrated into oncology pathways (NSCLC, CRC, BC).

Rollout Timeline

- Months 0–2: Protocols, consent, payor/reimbursement review, kit training.

- Months 3–5: Soft launch in lung and colorectal cancer; weekly QA reviews.

- Months 6–9: Scale to breast, prostate, and melanoma; introduce serial monitoring (baseline + cycle 2 + progression).

- Month 12: Network-wide adoption with shared analytics dashboards.

Clinical & Operational Outcomes (12-Month Window)

- TAT to first actionable genomic result: median reduced from 15 days to 5 days (–67%).

- Treatment selection speed: median time from consult to targeted therapy start improved from 21 to 10 days (–52%).

- Repeat testing feasibility: >70% of advanced-stage patients received serial liquid biopsy (vs. <20% repeat tissue biopsies historically).

- MRD/recurrence detection: earlier molecular signals prompted therapy adjustments in 28% of monitored cases (across CRC, BC, NSCLC).

- Trial matching: screen-fail rates declined; trial enrollment up 2.1× in genomically eligible cohorts.

- Cost & access: fewer complication-prone tissue re-biopsies and fewer non-diagnostic attempts; community clinics could offer precision testing without on-site interventional radiology.

-

Patient experience: reported higher satisfaction due to non-invasive sampling and fewer travel days.

Workflow Snapshot (NSCLC Pathway)

- Baseline liquid biopsy at diagnosis or at progression on first-line therapy.

- AI flags actionable mutations (e.g., EGFR exon 19 del, ALK fusion).

- If negative or low tumor fraction, reflex to tissue or repeat liquid biopsy in 10–14 days.

- Serial liquid biopsy every 6–8 weeks to monitor response/resistance; MRD signal triggers imaging sooner.

- Decision support surfaces relevant labelled options + active trials.

Keys to Success

- Dual-modality mindset: Liquid biopsy complements (not replaces) tissue—especially for IHC/FISH needs and comprehensive histopathology.

- Data ops: Clean interfaces between LIS/LIMS, EHR, and analytics; structured variant data (HGVS) for searchability.

- Reimbursement playbook: Clear documentation (ICD-10, prior auths), payer education on utility in treatment monitoring.

- Change management: Training for oncologists, nurses, and tumor board coordinators; quick-reference guides on when to order serial testing.

What This Means for the Parent Market (Cancer Biopsy)

- Liquid biopsy expands total diagnostic throughput and reduces procedural bottlenecks—growing the overall cancer biopsy market while shifting a portion of volumes toward minimally invasive, repeatable testing.

- As networks standardize NGS + AI workflows, demand rises for kits & consumables, instruments, services, and bioinformatics, reinforcing growth across categories.

Representative Use Cases by Indication

- Lung cancer (NSCLC): rapid detection of targetable mutations; resistance tracking (e.g., EGFR T790M, MET amp).

- Colorectal cancer: earlier detection of MRD post-resection to guide adjuvant therapy.

- Breast cancer: non-invasive monitoring of endocrine resistance variants; therapy optimization.

- Prostate & urologic cancers: urine-based assays augment blood tests for screening/monitoring in low-resource settings.

Quote for Editors (Attributable to a Clinical Leader, Placeholder)

“By pairing liquid biopsy with AI-driven analytics, we cut time to targeted therapy in half and made serial monitoring routine—even for patients who can’t undergo repeat tissue biopsies. It’s a game-changer for access and outcomes.”

How to Use This in Your Release

- Place under “Real-World Impact / Case Study” after your market overview and key takeaways.

- Keep anonymized, or replace with a client’s name once approvals are secured.

- Optionally add a small visual (flow diagram: Order → Sample → NGS → AI report → Decision).

See how AI-powered liquid biopsy accelerates diagnosis and treatment – Download the Complete Analysis

How Can AI Help the Liquid Biopsy?

Artificial intelligence enhances the specificity and sensitivity of biopsy testing for the detection of gastrointestinal cancer. The integration of multi-omics for precision diagnostics is enabled by machine learning models. AI-based algorithms enable the effective profiling of exosomes and ctDNA biomarkers. AI-powered liquid biopsy assists in real-time monitoring and the detection of minimal residual disease.

What are the Major Breakthroughs in the Liquid Biopsy Market?

- In April 2025, Tvaster Genkalp raised $1.25 million in pre-series A funding to advance liquid biopsy cancer diagnostics and drive the commercialization of Episcreen™ Liver, a pioneering methylation-based liquid biopsy test for the early detection of liver cancer. (Source: https://ehealth.eletsonline.com )

- In January 2025, OneCell Diagnostics secured $16 million to advance cancer diagnostics through the investment led by Celesta Capital, Cedars Sinai, Eragon, Tenacity Ventures, and Singularity Ventures. These investments is an oversubscribed series a funding round for cancer diagnostic advancements. (Source: https://www.digitalhealthnews.com)

Recent News Shaping the Liquid Biopsy Market

The momentum behind liquid biopsy is being reinforced by several major breakthroughs and clinical rollouts in 2025:

Exact Sciences Expands Multi-Cancer Early Detection

In September 2025, Exact Sciences announced the launch of Cancerguard, a novel liquid biopsy test designed to screen for more than 50 different types of cancer from a single blood sample. This advancement positions liquid biopsy as a potential frontline tool for multi-cancer early detection, complementing existing imaging and diagnostic pathways. Industry experts view it as a milestone in the transition toward accessible, broad-spectrum screening solutions for global healthcare systems.

NHS England Adopts Liquid Biopsy as First-Line Tool

In May 2025, the UK’s National Health Service (NHS) introduced liquid biopsy-based DNA testing as a first-line diagnostic option for patients with suspected lung and advanced breast cancers. Early trials demonstrated that liquid biopsy results were delivered up to 16 days faster than traditional tissue biopsies, enabling earlier initiation of targeted therapies and reducing the need for invasive surgical sampling. The NHS move highlights a growing institutional commitment to integrating liquid biopsy into mainstream cancer care.

AstraZeneca Leverages Liquid Biopsy in Breast Cancer Trials

At ASCO 2025, AstraZeneca revealed promising results from a clinical trial where liquid biopsy was used to detect ESR1 mutations in patients with advanced breast cancer. When treatment was switched to the oral selective estrogen receptor degrader Camizestrant based on liquid biopsy findings, the risk of disease progression or death dropped by 56% compared with patients who remained on standard care. This trial underscores the clinical power of liquid biopsy to guide real-time therapy adjustments.

ctDNA Studies Detect Recurrence Earlier

At the 2025 American Association for Cancer Research (AACR) meeting, new data showed that ctDNA-based liquid biopsy assays were able to detect colorectal cancer recurrence months before conventional imaging methods. Early molecular detection allows oncologists to intervene sooner, adjust therapies, and potentially improve long-term outcomes for patients.

Industry Round-Ups Highlight Funding and Validation

Recent industry analyses point to a surge of investment in MRD detection tools, reimbursement expansions, and new validation studies across the U.S., Europe, and Asia. These developments signal that liquid biopsy is moving rapidly from research to routine practice, with AI and next-generation sequencing technologies strengthening clinical confidence in the results.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

What are the Major Concerns in the Market?

-

Data Computation: It imposes significant challenges in genomic analysis due to the complexity of a vast amount of data. Computational researchers find issues during comparative studies and real-time survival analysis. Furthermore, data visualization and clinical-decision support systems face problems in the effective visualization and interpretation of complex datasets.

-

Utilization in Clinical Practice: The use of liquid biopsies for clinical purposes brings challenges related to utility assessment and workflow adaptation. Certain concerns arise with the availability and reimbursement of NGS technology in many regions that are dealing with the rising incidence of mutations.

Liquid Biopsy Market Report Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 6.17 Billion |

| Market Size in 2025 | USD 7.05 Billion |

| Market Size in 2031 | USD 15.93 Billion |

| Market Size by 2034 | USD 22.69 Billion |

| Growth Rate 2025 to 2034 | CAGR of 13.91% |

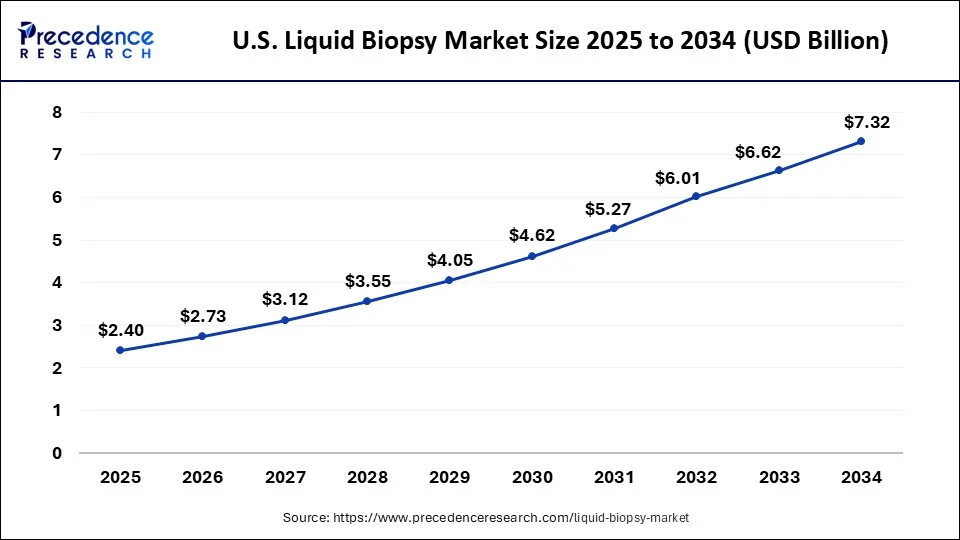

| U.S. Market Size in 2025 | USD 2.40 Billion |

| U.S. Market Size by 2034 | USD 7.32 Billion |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Usage, Types of Sample, Circulating Biomarker, Products, Indication Type, Clinical Application, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | Bio-Rad Laboratories, Biocept Inc., Guardant Health, Illumina, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, Laboratory Corporation of America Holdings, MDxHealth SA, QIAGEN N.V, Thermo Fisher Scientific Inc., and Others |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

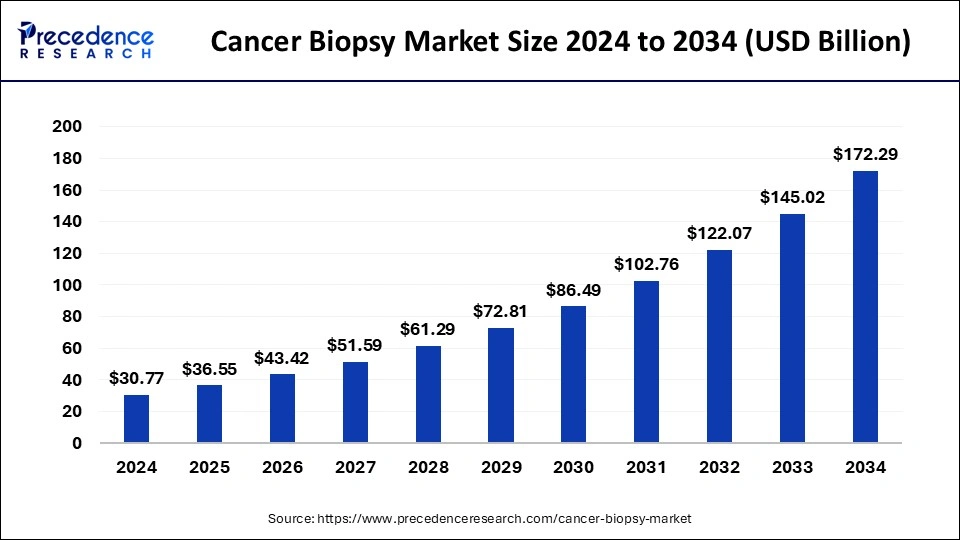

How Is the Liquid Biopsy Market Powering Growth in the Cancer Biopsy Industry?

The liquid biopsy market is not just a fast-growing niche, it is a critical driver of the broader cancer biopsy industry, which is projected to surge from USD 36.55 billion in 2025 to USD 172.29 billion by 2034. Traditionally, cancer biopsies relied heavily on invasive tissue and surgical procedures. While effective, these approaches often posed challenges such as patient discomfort, longer turnaround times, and limitations in repeated monitoring.

Liquid biopsy is changing that landscape. Its minimally invasive nature, ability to detect cell-free DNA, circulating tumor cells, and exosomes, and its role in real-time monitoring of cancer progression make it a complementary and sometimes preferable alternative to conventional methods. This is accelerating adoption within hospitals, diagnostic labs, and cancer research centers, thereby fueling growth across the overall cancer biopsy market.

Moreover, as AI and next-generation sequencing (NGS) enhance the sensitivity and accuracy of liquid biopsy tests, healthcare providers are increasingly integrating them alongside traditional biopsies. This dual approach expands diagnostic capacity, improves early cancer detection rates, and contributes to the steady expansion of the cancer biopsy industry.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1514

In essence, while the cancer biopsy market provides the broad umbrella, liquid biopsy is emerging as one of its fastest-growing engines of innovation and revenue, shaping the future of precision oncology worldwide.

Cancer Biopsy Market Key Takeaways

- North America led the global market with the highest market share of 47% in 2024.

- By type, the tissue biopsy segment is estimated to capture the biggest revenue share in 2024.

- By type, the liquid biopsy segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By product, the kits and consumables segment predicted to register the maximum market share of 61% in 2024.

- By application, the breast cancer segment is estimated to hold the highest market share in 2024.

Cancer Biopsy Market Leading Companies

- Myriad Genetics Inc.

- Guardant Health Inc.

- Exact Sciences Corporation

- Bio-Rad Laboratories Inc.

- Agena Bioscience Inc.

- Personal Genome Diagnostics Inc.

- Exosome Diagnostics Inc.

- ANGLE Plc.

- F. Hoffmann-La Roche Ltd.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1514

How does North America Dominate the Liquid Biopsy Market in 2024?

North America held the major revenue share in the market in 2024, owing to the excellent efforts of cancer research organizations to prevent and cure cancer. These efforts are majorly driven through research, education, communication, collaboration, science policy, advocacy, and funding for cancer research.

The association between several organizational members, countries, and territories contributes to successful clinical research. The initiatives from the National Cancer Institute (NCI) and the regulatory approvals from the U.S. Food and Drug Administration (FDA) fuel the North American growth in cancer research and development. The American Association for Cancer Research reported on the expansion of liquid biopsies led by the potential of these tests in the detection and monitoring of cancer.

- In June 2025, GeneCentric Therapeutics secured $8 million for the launch of a liquid biopsy platform to advance biopsy testing through the detection of gene expression and gene mutations. This platform provides simultaneous gene expression measurements and DNA variant detection from circulating tumor DNA’s single sample. (Source: https://www.medicaldevice-network.com/)

How U.S. Dominated the Liquid Biopsy Market?

According to Precedence Research, the U.S. liquid biopsy market size is estimated to be worth over USD 7.32 billion by 2034 increasing from USD 2.40 billion in 2025. The industry is expanding at a double-digit CAGR of 13.91% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2474

U.S. Liquid Biopsy Market Key Takeaways

- By biomarker types, the circulating tumor cells (CTC) segment is anticipated to dominate the market from 2025 to 2034.

- By application, the cancer therapeutic application segment had the major market share in 2024.

- By the sample, the blood sample segment is predicted to expand at the biggest rate from 2025 to 2034.

- By end-user, the hospitals and laboratories segment had the major market share in 2024.

U.S. Liquid Biopsy Market Companies

- ANGLE plc, Biocept Inc.

- Bio-Rad Laboratories Inc.

- Epigenomics AG

- Exact Sciences Corporation

- F. Hoffmann-La Roche AG

- Guardant Health Inc.

- Illumina Inc.

- MDxHealth SA

- Menarini Silicon Biosystems

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

U.S. Market Trends

The countries like the U.S., Japan, India, and Australia launched the Cancer Moonshot Initiative to help combat the rising incidence of diseases like cervical cancer in the Indo-Pacific region.

The National Cancer Institute (NCI), the Division of Cancer Prevention, introduced the liquid biopsy consortium, which is an industrial/academic partnership program. This program aims to advance and verify liquid biopsy technologies that are targeted for early-stage cancer detection.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2474

What is the Potential of the Liquid Biopsy Market in the Asia Pacific?

Asia Pacific is estimated to be the fastest-growing region in the market during the predicted timeframe due to multiple government-backed initiatives in this region. The government has made advances in biopsy testing and cancer care. The Asian Pacific countries, like India, are focusing on cancer diagnosis and screening through initiatives like the Quad Cancer Moonshot. The expansion of cancer care programs, day care centers, and affordable diagnostics fueled cancer-related services across the region.

India Market Trends

The Ministry of Health and Family Welfare is committed to a cancer-free India through the prevention, treatment, and innovation in cancer. The Government of India introduced robust policies, financial assistance schemes, and strategic interventions to prevent, detect, treat, and advance patient care across the nation.

- In August 2025, IndiaAI Independent Business Division and the National Cancer Grid (NCG) launched the Cancer AI & Technology Challenge (CATCH) Grant Program to support AI innovations in cancer screening, diagnosis, and treatment. CATCH announced offering of around Rs 50 lakh per project for selection of teams comprising technology advancements and clinical institutions.(Source: https://www.pib.gov.in/)

Liquid Biopsy Market Segmentation Analysis

Technology Analysis

How does the NGS Segment Dominate the Liquid Biopsy Market in 2024?

The NGS segment held the highest revenue share in the market in 2024, owing to the excellence of the next-generation sequencing (NGS) along with liquid biopsy in real-time and non-invasive cancer monitoring. These cutting-edge technologies enhance precision medicine and deliver high-sensitivity applications. The NGS contributes to improved workflows and expands clinical applications.

The PCR segment is expected to be the most opportunistic in the market during the forecast period due to the cost-effectiveness, speed, and high-throughput results of this molecular diagnostic technique. The extensive use of various PCR techniques for detecting diseases expands their applications in clinical practice. PCR in liquid biopsy plays a vital role in early cancer detection and confirmatory testing.

Usage Analysis

What made Clinical the Dominant Segment in the Liquid Biopsy Market in 2024?

The clinical segment dominated the market in 2024. The segment is expected to sustain the fastest-growing position in the market during the predicted timeframe due to the primary clinical applications of liquid biopsies, such as genomic profiling for treatment selection and monitoring minimal residual disease.

The rising need for multi-cancer early detection and adjuvant therapy is fulfilled by these clinical applications of biopsies. The inclusion of advanced technologies in clinical practice has enabled the identification of genetic mutations, which is vital for further treatment decisions.

Products Analysis

How did the Test/Services Segment Dominate the Liquid Biopsy Market in 2024?

The test/services segment dominated the market in 2024, owing to the preferences for various kinds of targeted therapies and immunotherapies for early disease detection and screening. Moreover, the services related to liquid biopsies are exploring the use of alternative biofluids like saliva, urine, and cerebrospinal fluid to gain more specific insights for specific cancers. These services are expected to be prominent in head, neck, or urological cancers.

The kits and consumables segment is expected to grow at a notable CAGR in the market during the upcoming period due to the crucial need for the collection and preparation of samples, as well as analysis and detection. These laboratory products are very useful in the isolation of biomarkers and the preservation of desired samples. The high demand for reagents, reaction kits, and collection tubes, and the continuous innovation in these products, drive their expansive reach in the global market.

Induction Analysis

Which Segment by Indication Type Dominated the Liquid Biopsy Market in 2024?

The lung cancer segment held the highest revenue share in the market in 2024, owing to the key role of liquid biopsies in the early-stage detection of lung cancer. The biopsy tests for lung cancer help in the prognosis, detection of minimal residual disease, and screening. These tests are expected to be versatile in the detection of squamous cell carcinoma and small cell lung cancer.

The breast cancer segment is expected to be the fastest-growing in the market during 2025-2034 due to the rising trend of personalized breast cancer management. The availability of minimally invasive ways to detect breast cancers and monitor treatment responses raises the treatment standards. The possible medical solutions can predict cancer recurrence and guide targeted therapies.

Clinical Application Analysis

How does the Treatment Monitoring Segment Dominate the Liquid Biopsy Market in 2024?

The treatment monitoring segment dominated the market in 2024, owing to the technology integration for the assessment of treatment response and guidance of targeted therapies. The critical tools, like liquid biopsies, can assess the effectiveness of treatments and predict the recurrence of cancers. The access to adaptive treatment strategies and personalized treatment plans makes healthcare services friendly and convenient to cancer patients.

The prognosis and recurrence monitoring segment is expected to grow at a notable CAGR in the market during the studied period due to the huge adoption of personalized treatments, precision medicine, and adjuvant therapies. The skilled healthcare professionals and their expertise contribute to improved patient care. The union of manual expertise and technological power made healthcare possible to diagnose, detect, treat, and monitor diseases like cancer effectively.

Type of Sample Analysis

Which Type of Sample Dominated the Liquid Biopsy Market in 2024?

The urine segment dominates the market in 2024, due to its increased use for urological cancers such as bladder and prostate cancer, thanks to advantages like non-invasiveness, ease of collection, low cost, and the ability to collect large sample volumes.

Advances in molecular diagnostics (better sensitivity and specificity for detecting cfDNA, exfoliated cells, proteins, etc., in urine) are helping reduce past technical limitations. Because of these factors, urine-based tests are increasingly seen as a convenient alternative or complement to blood-based tests, particularly for monitoring, screening in low-resource settings, or for cancers that directly shed material into urine.

Circulating Biomarker Analysis

What Made the Cell-Free DNA Segment to Lead the Liquid Biopsy Market?

In 2024, the cell-free DNA segment led the market, driven by early detection & minimal residual disease monitoring, technological advances, and non-invasive nature. The cell-free DNA allows detection of tumor-derived mutations, even at low frequencies, which is useful for early cancer diagnosis, tracking minimal residual disease after treatment, and monitoring recurrence.

Improvements in sequencing (especially NGS), digital PCR, and bioinformatics increase sensitivity & specificity, allowing detection of small fractions of mutated DNA in the background of normal cfDNA.

Liquid Biopsy Market Top Companies Analysis

➡️ Guardant Health – Offers a comprehensive portfolio of liquid and tissue-based precision oncology tests, including Guardant360® for genomic profiling and Guardant Reveal® for minimal residual disease detection2.

➡️ Biocept Inc – Provides the Target Selector™ NGS Lung Panel, a liquid biopsy test that enables genomic profiling for non-small cell lung cancer using circulating tumor DNA.

➡️ Hoffmann-La Roche Ltd – Delivers a robust liquid biopsy portfolio including AVENIO ctDNA Analysis Kits and cobas® EGFR Mutation Tests for tumor profiling and monitoring.

➡️ Illumina Inc. – Powers liquid biopsy research with next-generation sequencing assays like TruSight Oncology 500 ctDNA v2, enabling comprehensive genomic profiling from blood samples6.

➡️ Qiagen – Offers end-to-end liquid biopsy solutions including cfDNA extraction kits, exosome isolation, and NGS panels for cancer biomarker detection and monitoring8.

➡️ Thermo Fisher Scientific Inc. – Provides complete workflows for liquid biopsy analysis, including MagMAX cfDNA kits and Oncomine assays for cancer mutation detection and monitoring10.

➡️ Myriad Genetics – Features the Precise™ Oncology Solutions suite, integrating liquid biopsy therapy selection with hereditary and tumor profiling for personalized cancer care12.

➡️ NeoGenomics – Offers PanTracer LBx, a blood-based genomic profiling test analyzing over 500 genes for therapy selection, trial matching, and longitudinal cancer monitoring14.

➡️ Roche – Through Foundation Medicine, offers FoundationOne®Liquid CDx, a pan-tumor liquid biopsy test analyzing over 300 genes to guide treatment decisions for solid tumors.

➡️ Natera, Inc. – Specializes in personalized ctDNA monitoring with its Signatera™ test, designed for minimal residual disease detection and recurrence monitoring across cancer types17.

➡️ Bio-Rad Laboratories – Leverages Droplet Digital™ PCR (ddPCR) technology to deliver ultra-sensitive liquid biopsy assays for cancer detection, monitoring, and recurrence screening.

➡️ GRAIL – Developed the Galleri® test, a multi-cancer early detection blood test that screens for over 50 cancer types using methylation-based ctDNA analysis.

What is Going Around the Globe?

- In November 2025, Thermo Fisher Scientific Inc. announced the approval from the U.S. Food and Drug Administration (FDA) for its Oncomine Dx Target Test as a companion diagnostic (CDx) for the treatment of new non-small cell lung cancer. This test can act as companion diagnostic for identification of patients with candidate for HERNEXEOS, a tyrosine kinase inhibitor, developed by Boehringer Ingelheim.(Source: https://newsroom.thermofisher.com )

- In August 2024, Illumina Inc. announced the launch and expansion of its oncology menu for NovaSeq™ X Series customers to advance the delivery of its flagship oncology products and enable genomic profiling at lower costs and enhanced scalability for customers. The company has stated poriving novel verified high-throughput version of TruSighTM oncology 500 and the new version of its distributed liquid biopsy research assay. (Source: https://www.illumina.com/company)

Liquid Biopsy Market Segments Covered in the Report

By Technology

- NGS

- PCR

- FISH

- Other

By Usage

- RUO

- Clinical

By Products

- Test/Services

- Kits and Consumable

- Instruments

By Indication Type

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Other cancers

- Non-Oncology Disorders

By Clinical Application

- Treatment Monitoring

- Prognosis and Recurrence Monitoring

- Treatment Selection

- Diagnosis and Screening

By Types of Sample

- Blood

- Urine

- Saliva

- CerebroSpinal Fluid

By Circulating Biomarker

- Circulating Tumor Cells

- Cell-free DNA

- Circulating Cell-Free RNA

- Exosomes and Extracellular Vesicles

- Others

By Region

North America

- U.S.

- Canada

- Mexico

Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1398

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Fusion Biopsy Market: See how fusion imaging technologies are enhancing accuracy in prostate and other cancer biopsies.

➡️ Biopsy Devices Market: Learn how next-gen biopsy tools are transforming minimally invasive cancer diagnosis.

➡️ Cancer Diagnostics Market: Explore how molecular and imaging diagnostics are reshaping personalized cancer care.

➡️ Breast Cancer Diagnostics Market: Track how innovations in screening and imaging are revolutionizing early breast cancer detection.

➡️ Biopsy Bag Market: Understand how sterile biopsy bags support safe specimen collection and reliable lab outcomes.

➡️ Lung Cancer Diagnostics Market: See how liquid biopsy and AI-powered imaging are advancing lung cancer detection.

➡️ Blood Cancer Diagnostics Market: Discover how molecular profiling and genetic tests are improving leukemia and lymphoma diagnosis.

➡️ Endomyocardial Biopsy Market: Learn how cardiac biopsy techniques are aiding diagnosis of heart transplant rejection and rare cardiomyopathies.

➡️ Bronchial Biopsy Devices Market: Explore how innovative biopsy devices are enabling safer and more accurate lung tissue sampling.

➡️ Colorectal Cancer Diagnostics Market: Track how non-invasive screening tools and biomarkers are transforming colorectal cancer detection.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.